Premium Preview: Drift Vaults - Permissionless Asset Management Pools on Drift with +35% APY

Drift is one of the leading decentralized exchanges (DEXs) on Solana, offering spot, margin, and perpetuals trading alongside integrated lending and borrowing markets. These features enable traders and liquidity providers to leverage their positions effectively. Drift stands out for its Just-in-Time Liquidity System, which leverages active market maker participation to deliver the most cost-efficient trades with minimal slippage and tight spreads compared to its competitors.

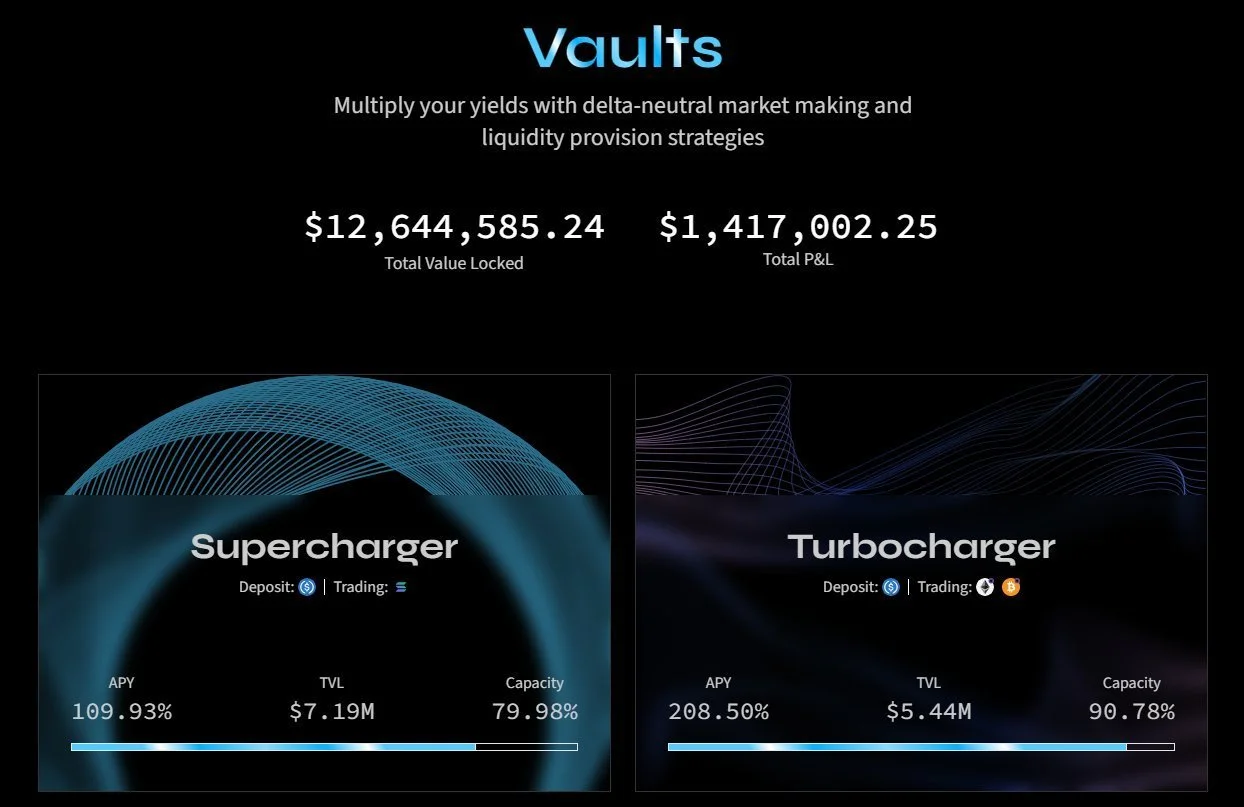

In a recent innovation, Drift launched its Vaults feature, allowing users with market expertise to create and manage asset management vaults using Drift’s proprietary, audited developer toolkit. This feature empowers users to capitalize on market opportunities through one of the largest DEXs on Solana.

Drift Vaults

Mechanism:

Drift Vaults empower users to develop and deploy custom asset management solutions directly on the Drift protocol using the comprehensive toolkit and technical framework provided by the Drift team. These Vaults seamlessly integrate with Drift’s spot, margin, and perpetuals markets, offering a robust platform for advanced trading strategies.

Vault creators design their own trading strategies and allocate funds deposited into the Vaults with the goal of outperforming market averages. Popular strategies include leveraged long/short positions, pair trading, basis trading, and hedged Just-in-Time Liquidity Provision (JLP) with leverage, enabling users to maximize potential returns while leveraging the capabilities of the Drift ecosystem.

Vault Example - Delta-Hedging JLP (hJLP) Vault managed by Gauntlet

JLP, the liquidity provision token of Jupiter Exchange, represents holders' shares in a diversified basket of assets, including BTC, ETH, SOL, USDC, and USDT. By holding JLP, investors act as counterparties to traders on Jupiter, earning trading fees, borrowing fees, and the opposite of traders’ profit and loss (PnL).

Jupiter’s Perpetual Platform has been highly successful, generating over $180 million in fees since its inception, delivering substantial returns to JLP holders. However, JLP investors face risks associated with crypto price volatility and exposure to traders’ PnL.

To address these challenges, the hJLP strategy developed by Gauntlet offers an automated hedging solution. This strategy mitigates risks by dynamically hedging against both price swings and trader PnL exposure, enhancing the risk-adjusted returns for JLP holders.

Mechanism :

1. When USDC is deposited into the vault by users, Gauntlet swaps it into JLP in return

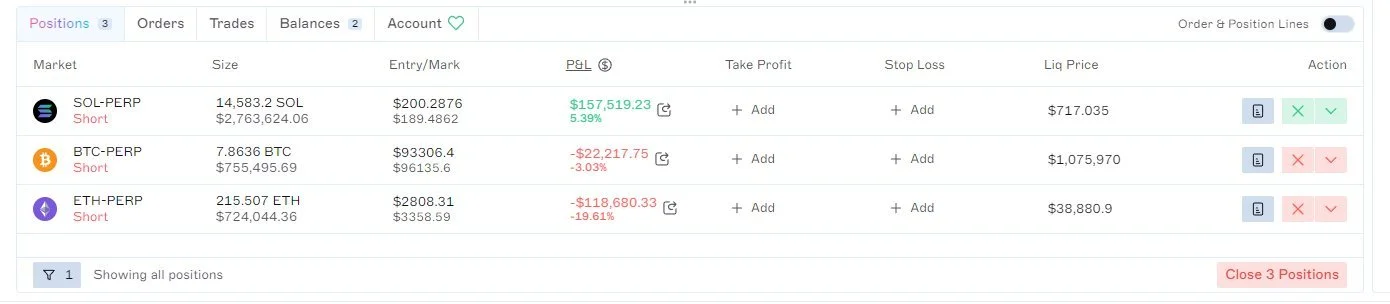

2. The JLP is then deposited into Drift and used as the collateral in perpetuals market

3. Gauntly opens short BTC, ETH, and SOL perpetuals position corresponding to the exposures of JLP’s underlying asset basket to neutralize the delta of the user positions

4. User can still earn trading fee and borrowing fee from the traders on Jupiter while no need to worry about the market volatility

Risks :

- JLP is a token generated by a smart contract and is subject to changes and upgrades, such as updated parameters, revised asset composition, and smart contract updates.

- While the code is audited by third parties, JLP holders assume risks of hacks or malfunction. JLP is also subject to market risk including high market volatility resulting in socialized losses to the liquidity pool.

- The hedged vault carries additional risks related to the management of positions including the risk of data errors, execution risk in the hedging strategy, low liquidity on Drift inhibiting the vault from hedging the full delta exposure, and liquidation risk on the hedge positions during times of high volatility.

Deposit Guide

Go to Drift Vaults Page and connect the wallet

Find the vault you would like to deposit into and click View Vault

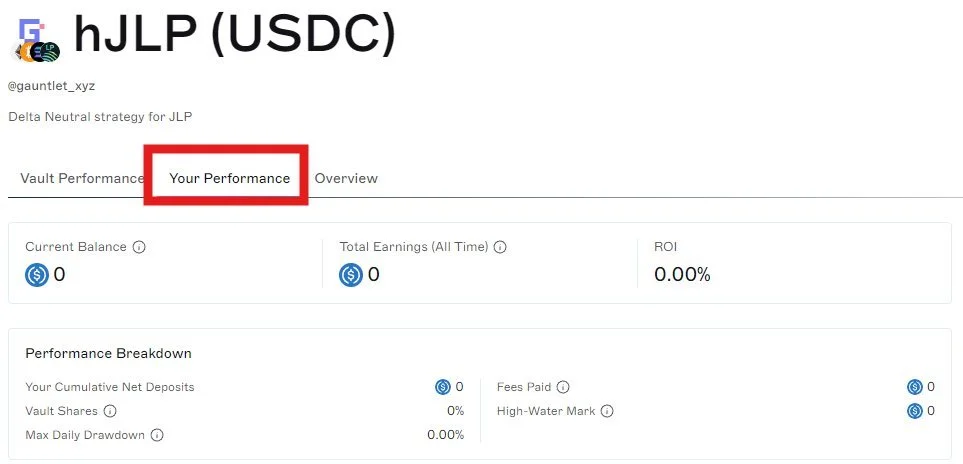

3. On the vault page you can check the information about the vault such as performance, APY, vault composition, etc.

4. Click on overview to read the strategy description, risk disclosure, and other specifications

5. Enter the amount of USDC to deposit and confirm

7. Make sure to check the performance of your deposit and compare with the vault performance

9. Go to Gauntlet’s JLP risk dashboard to check the token’s risk profile

Benefits

🌟 Very good APY for with minimal delta exposure

🌟 Transparent dashboards to monitor the risk profile of vaults

Risks Involved

⚠️ Drift smart contract risk

⚠️ Vault deployer management risk

Security

✅ Drift is

by Trail of Bits

The audit does not guarantee any hacks. Please do not invest with more than you can afford to lose.

Enjoy this content?

Subscribe to Today in DeFi Premium and enjoy more actionable research and guides like this.