Last Week in DeFi: Cap Money Launches Stablecoin, Wormhole Updates Stargate Acquisition, Aave Live on Aptos, and more...

Launches 🚀

Cap launched its stablecoin protocol on Ethereum, introducing cUSD and stcUSD with a points-based Frontier Program. Users can mint cUSD with USDC, while idle USDC is deployed into Aave to earn base yield, stcUSD is listed on Pendle, and Chainlink powers the cUSD oracle.

The protocol completed five audits and open-sourced its codebase ahead of launch.

Re launched its protocol on Base, bringing real-world reinsurance on-chain through fully backed insurance programs and stable capital strategies. The platform is available to qualified, non-US users with KYC requirements.

USD.AI launched on Arbitrum, enabling users to deposit USDC through its application. The launch transitions the protocol from earlier limited phases to full availability, positioning it as an AI-driven stablecoin yield platform. Access is available at app.usd.ai.

Circle launched Circle Gateway on mainnet, providing a unified USDC balance accessible across chains in under 500 ms. It is live on Arbitrum, Avalanche, Base, Ethereum, Optimism, Polygon, and Unichain, with Arc and more to follow.

Aave V3 has gone live on Aptos, marking its first non-EVM deployment. The protocol was rewritten in Move, audited multiple times, and tested through a CTF competition, with a $500,000 GHO bug bounty ongoing. At launch, Aave supports native USDC, USDT, APT, and sUSDe, with additional user rewards and liquidity incentives planned by the Aptos Foundation.

Updates 📰

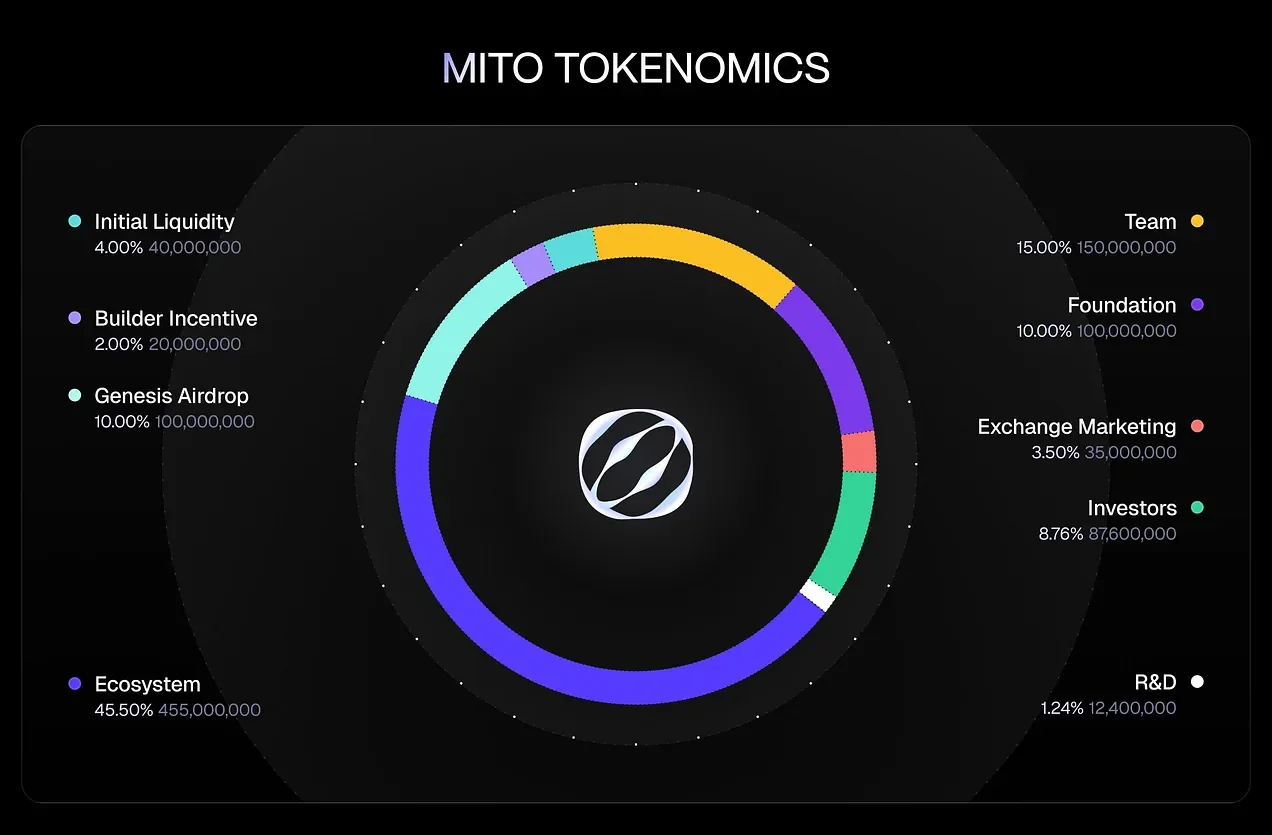

Mitosis introduced its native token, $MITO, which will launch on the Mitosis Mainnet as both a stakeable gas token and part of a broader three-tier architecture with governance MITO (gMITO) and locked MITO (LMITO). The token distribution allocates 45.5% to the ecosystem, 10% to a genesis airdrop, 15% to the team, and smaller portions to investors, foundation, and other categories, with a total supply of 1 billion.

Incentives will run through the DNA program, which distributes LMITO for providing liquidity and engaging with dApps, replacing traditional grant committees.

Mitosis also announced a validator collateral system designed to eliminate staker slashing risks and better align validator incentives.

OpenEden introduced EDEN, the native token for its RWA ecosystem. EDEN will support governance, staking, ecosystem incentives, platform utility, and treasury buybacks as OpenEden expands its regulated, yield-bearing asset offerings on-chain.

As part of its Bills Campaign Airdrop, 7.5% of EDEN will be distributed fully unlocked to participants, with a “HODLer Bonus Mechanism” rewarding long-term holders. More details are expected on September 15.

BasedApp has rebranded as BASED, positioning itself as a full ecosystem rather than just an app. The move focuses on global expansion, deeper Hyperliquid integrations, new payment and DeFi tools, and upcoming product launches.

The team emphasizes scaling crypto usability while staying non-custodial and community-driven.

Hyperdrive has added support for yield-bearing assets in new USDT0 markets. The Treasury market now includes Theo Network’s thBILL, while the Pioneer market features Hyperwave’s hwHLP and HyperBeat’s hbUSDT. Users can leverage loop these assets to maximize yields and points or borrow against them while continuing to earn.

Risk parameters are set by Allez Labs, with collateral price oracles provided by RedStone and Pyth Network.

Euler has gone live on Linea, bringing ETH-focused lending markets with institutional-grade risk controls. The launch introduces four isolated ETH markets — WETH, wstETH, ezETH, and weETH — designed for high-efficiency collateral use and LST/LRT looping strategies.

DFlow integrated PancakeSwap on Solana, allowing its order flow marketplace to access liquidity from the leading DEX. PancakeSwap has already surpassed $400 million in Solana trading volume since launch, and the integration is aimed at improving quote quality and market depth within DFlow.

Renzo’s ezETH has been added to Aave’s Core Market, enabling it to be used as collateral and expanding liquidity options for restakers.

The integration follows a governance proposal that included ezETH alongside assets like wstETH, USDC, and USDT in emode.

Valantis Labs acquired the stakedhype protocol and will oversee development, expansion, and operations of $stHYPE. The asset will gain synchronous liquidity across HyperEVM and HyperCore, with plans for deeper integrations, expanded yield sources, and CoreWriter-enabled modular upgrades.

Valantis aims to position $stHYPE as the most liquid LST on Hyperliquid while maintaining security and continuity for existing users.

Gauntlet launched a levered RWA strategy using Pareto’s FalconX Credit Vault, in partnership with Pareto Credit and powered by Morpho vaults. The strategy loops Credit Vault tokens as collateral to borrow USDC and increase exposure under Gauntlet’s risk parameters.

FalconX Credit Vaults, curated by M11 Credit, enable protocol-to-business lending with institutional risk frameworks and historically low default rates.

Theo’s tokenized money market fund, thBILL, went live across multiple HyperEVM protocols. It is now supported on HypurrFi and Hyperdrive lending markets, enabling borrowing and leveraged yield strategies, and has been added to HyperSwap liquidity pools for trading and liquidity provision.

Renzo enabled native restaking on Linea, allowing users to mint ezETH directly through its dApp.

Wormhole Foundation updates its intent to bid for Stargate, challenging LayerZero’s $110 million offer. It argued the proposal undervalues Stargate, noting a treasury of about $92 million, $345 million in TVL, $4 billion in July bridge volume, and $2 million in projected annual revenue.

Wormhole requested a five-day pause on the governance vote to finalize a higher counteroffer and asked Stargate Foundation for detailed disclosures on assets, financials, and liabilities.

The foundation claimed that combining Stargate’s liquidity pools with Wormhole’s integrations could create a dominant cross-chain infrastructure provider.

Plasma announced a partnership with Binance Earn to introduce what it calls the first fully on-chain yield product to Binance’s global user base. The collaboration aims to channel USD₮ yields directly through Binance’s platform, expanding distribution to the widest pool of active crypto participants.

Across Protocol is now live on Solana, enabling bridging to and from the network using intents.

Titan unveiled Titan Prime, a new feature on its Solana-based exchange that auto-optimizes swap settings such as slippage and transaction landing. The tool aims to improve trade execution while offering swaps with zero fees, positioning cost savings as a core benefit for frequent traders.

Avantis launched trading for SPY and QQQ indices on its platform, offering up to $25 million in liquidity and 100x leverage for eligible non-US users. The move marks the start of its onchain equities roadmap, aiming to expand access to U.S. equity markets. Trading features include tight spreads, stop-loss guarantees, and feeds from Pyth Network, alongside a loss protection mechanism that rebates 10% on trades, helping balance open interest.

Avantis plans to add more liquidity, new equity listings, zero-fee perpetuals, and structured products in the coming weeks.

River integrated LayerZero to launch an omni-chain collateralized debt position (Omni-CDP). Users can deposit assets on any chain, mint satUSD where needed, and transfer it across ecosystems without bridges, wraps, or slippage.

Layer3 announced the launch of Pharos Network on its platform, featuring the testnet of an EVM Layer 1 focused on RWAs and traditional finance. Users can access and explore the Pharos testnet exclusively through Layer3.

Kamino introduced the USD Benchmark Rate, developed with Allez Labs, as a standardized reference for stablecoin yields in DeFi. The benchmark aggregates supply rates across Aave v3, Morpho, and Maker’s savings products for major stablecoins, including USDC, USDT, DAI, and USDS, weighted by deposit size.

It is now integrated into Kamino Earn’s stablecoin vaults, allowing users to compare vault performance against broader market rates.

Resolv Foundation activated its protocol fee mechanism, with 10% of daily profits now allocated to the foundation treasury.