Rabby Launched Hyperliquid Perps Trading, OpenSea Partners With Coinbase, Swissborg Hacked For $41M, and many more...

Launches 🚀

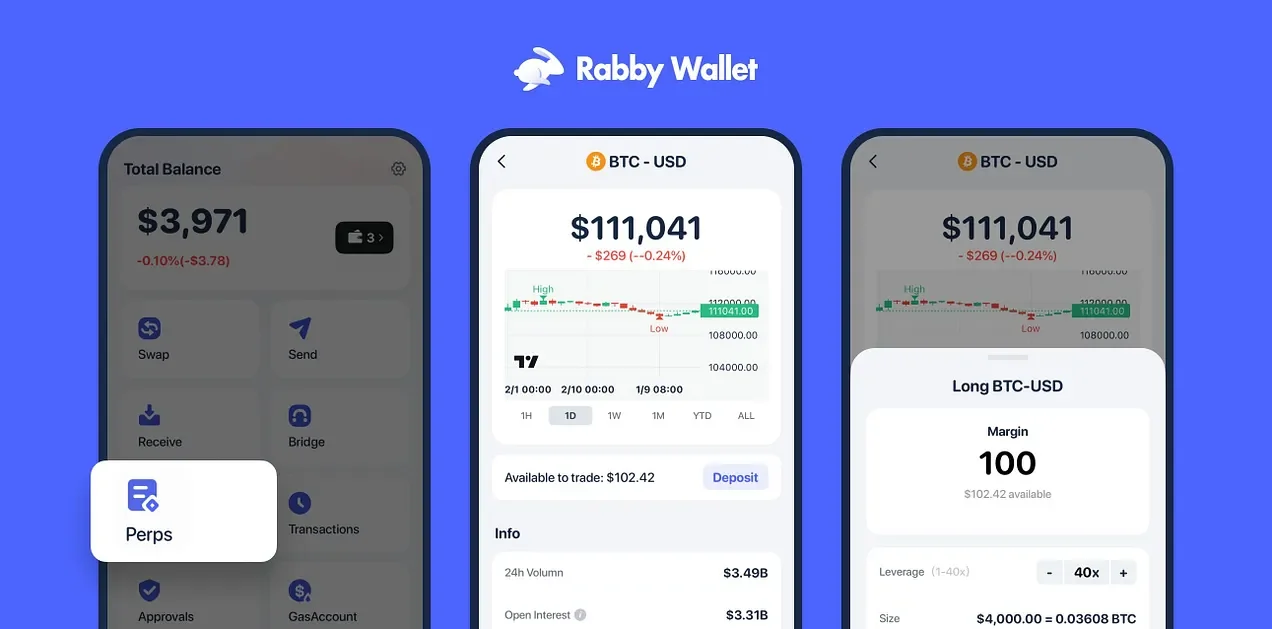

Rabby Wallet launched Rabby Perps on both its mobile app and browser extension, enabling perpetual trading with up to 40x leverage across 100 markets. The feature is powered by Hyperliquid and allows users to take long or short positions directly within the wallet. Perps are available on Rabby Mobile v0.6.35 and Rabby Extension v0.93.47, with users advised to update to the latest versions for access.

Hyperbeat launched beHYPE, an on-chain HYPE liquid staking token that enables staking with community validators and participation in validator governance. The protocol runs fully on-chain via CoreWriter and L1 precompiles, features on-chain exchange rate calculation, six-hour delegation cycles, and audits by Nethermind and Certora. A modular security framework extends beHYPE to slashable security for HIP-3 exchanges, vaults, and other custom modules defined by community rules.

For additional yield, users can route HYPE or beHYPE to the liquidHYPE vault on HyperEVM, which allocates across DeFi strategies based on risk-adjusted returns.

Giza launches Pulse, an autonomous agent built with Pendle to optimize principal token portfolios, launching first on Arbitrum’s ETH-PT markets with an initial ~13% APR. Pulse automates portfolio construction, slippage forecasting, real-time rebalancing, and maturity management while remaining fully non-custodial. The rollout starts with a $3M assets-under-agent cap and $300K in combined incentives. Giza said Pulse will expand to more assets and chains, positioning it as an intelligence layer on top of Pendle’s fixed-yield infrastructure.

Project 0 launched as a DeFi-native prime broker, allowing users to borrow against their entire multi-venue portfolio across platforms such as Kamino, Drift, and Jupiter. The platform introduces unified margin, risk, and portfolio management to improve capital efficiency, offering strategies from passive yield farming to arbitrage within a single account. Project 0 integrates a self-custodial account layer to manage liquidations without adding new smart contract risk.

It goes live with over 20 integrations, $100M in liquidity, and 200K users, with Kamino support set for October 8 and cross-margined perp and spot markets planned post-token launch.

Butter launched its first shadow market tied to Hyperliquid’s USDH proposals, allowing traders to bet on HYPE’s price depending on which option is selected. The “decision markets” provide real-time forecasts designed to guide validators and token holders with data-driven insights. Separate markets are live for proposals from Native Markets, Paxos, Frax, AUSD, and Sky.

Once a provider is chosen, only the corresponding market remains active, resolving about 12 hours after the decision based on HYPE’s price.

Updates 📰

StablecoinX raised $530 million in additional PIPE financing, bringing its total to about $895 million and targeting over 3 billion ENA tokens on its balance sheet. An Ethena Foundation subsidiary will conduct a $310 million buyback over 6–8 weeks, adding to the prior PIPE program.

Together, the two rounds represent roughly 20% of circulating ENA supply, with the Foundation retaining veto rights over any token sales.

Hylo introduced xSOL, a product offering 2–4x leveraged exposure to SOL without the risks of forced liquidation, funding rate costs, or the need for active management. The design allows users to capture amplified price movements with a straightforward buy-and-sell approach.

Ethena Labs announced a strategic investment and partnership with Based, which operates the largest builder codes platform on Hyperliquid, accounting for about 7% of perpetual trading volume. The collaboration will position Based as a key partner in driving adoption of Ethena products, including USDe, USDtb, and upcoming releases within the Hyperliquid ecosystem.

The move reflects Ethena’s continued support and expansion across Hyperliquid’s trading infrastructure.

Echelon announced the removal of all borrowing origination fees across its markets, making borrowing fully cost-free. The change applies to Aptos, Initia, and Move-based ecosystems, enabling more efficient looping strategies, costless hedging, and broader protocol growth.

The team described the update as a structural shift toward greater capital efficiency. Additional initiatives and updates are expected in the near future.

Resolv Foundation reported the continuation of its buyback program, with $60,000 used to acquire 420,000 RESOLV tokens at an average price of $0.143. The purchases were funded by 77% of the protocol’s core fee revenue from the past week.

Rune(Sky CoFounder) proposed launching USDH on Hyperliquid, powered by Sky (formerly MakerDAO), to combine stablecoin utility with yield and ecosystem growth. USDH would feature $2.2B in instant USDC redemption liquidity, multichain support via LayerZero, and a 4.85% return on Hyperliquid balances directed to HYPE buybacks. Sky also pledged $25 million to seed a Hyperliquid Genesis Star and move its $ 250 million-plus annual buyback engine onto the chain.

Backed by Sky’s $8B collateral base, 7+ year track record, and S&P credit rating, USDH would inherit robust risk management while offering Hyperliquid the ability to customize collateral and compliance.

Ethena Labs has submitted a proposal to issue USDH on Hyperliquid, positioning it as a GENIUS-compliant, Hyperliquid-first stablecoin. USDH would launch fully backed by USDtb, Ethena’s BlackRock BUIDL-collateralized dollar asset issued in partnership with Anchorage Digital Bank, ensuring institutional-grade security and compliance.

Ethena commits to directing 95% of USDH reserve revenues back to the Hyperliquid community through HYPE buybacks, validator distributions, and the Assistance Fund.

Security would be reinforced by an elected validator guardian network (with partners like LayerZero) to mitigate critical risks such as bridge or stablecoin failures.

Ethena Labs announced a major partnership with Binance to integrate USDe across the exchange’s platform, reaching over 280 million users and $190 billion in assets. USDe will serve as reward-bearing collateral for futures and perpetuals, be added to Binance Earn with yields alongside major stablecoins, and launch with a USDe-USDT spot pair.

The integration is designed to boost capital efficiency for traders and expand USDe’s role as a dollar-denominated asset. Further integrations on Binance are planned in the coming weeks.

Based unveiled the Based App Store, a composable trading terminal offering mini-apps for AI trading bots, liquidation heatmaps, and automated strategies. The platform is free for traders while providing a fee-share model for builders.

Nasdaq-listed StableX Technologies made its first token investment in Fluid, marking a major endorsement of DeFi’s unified liquidity layer. Fluid now handles 31% of stablecoin swap volume, plans buybacks, and has seen an 80% user surge in the past year.

OpenSea announced three major updates ahead of its $SEA token launch. The new OpenSea Mobile app introduces an AI-native trading experience unifying wallets, chains, tokens, and NFTs in one interface. OpenSea also launched a seven-figure Flagship Collection featuring historic and emerging NFTs, starting with CryptoPunk #5273.

The last pre-TGE rewards phase begins Sept. 15, with 50% of platform fees and $1M in $OP and $ARB fueling a prize vault tied to Treasure Chests.

$SEA TGE details will be released in early October.

Paxos proposed issuing USDH on Hyperliquid with PayPal and Venmo integration, alongside $20M in incentives. The plan sets a 20% alignment fee scaling with TVL, with Paxos charging nothing until supply tops $1B and capping fees at 5% past $5B.

Paxos also said Kraken has agreed to list its proposed USDH stablecoin and Hyperliquid’s HYPE token, pending completion of Kraken’s standard listing review. The plan includes free USD on- and off-ramps to support distribution and adoption.

Bitmine increased its Ethereum holdings by 46,255 ETH, valued at $201 million, bringing its total to 2,126,018 ETH worth about $9.2 billion.

OpenSea announced a partnership with Coinbase One that will integrate subscriber benefits into its Treasure Chest rewards program. Starting September 15, Coinbase One users will receive a 5% boost on marketplace activity along with surprise “Shipments.” Existing subscribers need to verify their wallets to access the rewards.

Hylo launched liquid staking tokens on Solana, supported by Sentinel Stake, with all staked SOL routed through the Hylo validator. The release includes hyloSOL, offering 7–10% APY with additional XP, and hyloSOL+, a SOL-pegged variant that directs yield to hyloSOL to maximize XP rewards. Hylo said the tokens form part of its vertical integration strategy, aiming to back protocol growth with its own validator infrastructure.

Aave added Circle’s USYC as collateral on the Horizon RWA market. USYC is a tokenized money market fund that provides yield-bearing collateral with near-instant redemptions, expanding the range of real-world assets available for borrowing and lending on Aave.

Superform deployed its v2 Core on mainnet chains under an open-source Apache license. The upgrade introduces ERC-7579 smart accounts with self-custody, support for complex multi-chain strategies executed via single signatures, and non-upgradeable contracts with no admin keys. The codebase has undergone more than five audits and security competitions, with ongoing monitoring in place.

Sei integrated Chainlink Data Streams to provide real-time data feeds for U.S. equities, GDP, and over 300 assets. The oracle service is now the standard for Sei’s ecosystem, supporting institutional-grade markets and applications at scale.

Jupiter Lend has been integrated into Binance Wallet, expanding access to its money market to millions of new users. The launch includes $300K in Global Dollar rewards to incentivize participation, alongside passive yield opportunities on deposited assets.

Kamino introduced a Multiply Backtesting feature, allowing users to simulate the historical performance of its leveraged strategies with customizable inputs such as pair, time period, leverage, and incentives.

Kamino said the tool will expand beyond SyrupUSDC to include SOL loops and real-world asset strategies.

Somm Finance launched its Alpha stETH Vault on Ethereum, Arbitrum, and Base. The strategy allocates dynamically leveraged stETH across Aave, Morpho, and Euler to generate yield, offering exposure to ETH rewards through a single product.

GammaSwap launched gBTC on Arbitrum, a synthetic token designed to replicate BTC exposure while generating yield. The product provides liquidity in the WBTC/WETH pool on Uniswap V3, with GammaSwap automatically hedging impermanent loss risk.

Yields come from trading fees minus hedging costs, though drawdowns may occur if positions move out of range and require rebalancing.

Issues ⚠️

Kinto announced it is shutting down after failing to secure further funding following the July CPIMP proxy exploit that drained 577 ETH. Users can continue withdrawing assets until September 30, after which remaining funds will be consolidated into USDC on Ethereum with a claim contract deployed in early October. Phoenix lenders will recover about 76% of their principal, while Morpho victims can claim up to $1,100 each from a goodwill grant and will receive any recovered funds through a CVR mechanism.

The team confirmed that the ERA airdrop will still be distributed on October 15 and emphasized that all recoveries will prioritize victims before distributing to the community.

A large-scale supply chain attack has been reported after the NPM account of a well-known developer was compromised. Malicious packages, already downloaded over a billion times, contain code that can silently swap crypto addresses to redirect funds.

Users with hardware wallets remain secure if they verify transactions before signing, while those using software wallets are advised to avoid on-chain transactions until further clarity emerges.

Investigators are still determining whether the attack also targets wallet seed phrases.

SwissBorg confirmed it was exploited for about 192.6K SOL ($41M) through a compromised partner API affecting its SOL Earn program. The company emphasized that the SwissBorg app and other Earn programs remain secure, with the incident impacting less than 1% of users.

A recovery plan is underway, including allocating SOL from its treasury to cover losses and working with white-hat hackers and security partners to attempt fund recovery.

SwissBorg said its financial health remains strong and community updates will follow, including a livestream with CEO Cyrus.

Nemo disclosed a security breach in its Market pool, prompting an immediate suspension of all smart contract activity while investigations are underway. The team emphasized that Vault assets were not impacted and is collaborating with partners to implement solutions and resume normal operations.

According to PeckShield, the exploit resulted in a $2.4 million loss, with the attacker bridging USDC from Arbitrum to Ethereum via Circle.

Nemo has pledged to provide further updates as the investigation develops and recovery measures are explored.

Polygon reported a temporary issue causing a 10–15 minute delay in finality, though blocks and checkpoints continue to be produced. The foundation said it identified a fix and is rolling it out to validators and service providers. An update will be provided once the issue is fully resolved, with status details available on Polygon’s status page.