Last Week in DeFi - Renzo Restaking Live, Immutable Launches Passport, ZKX Launching on Starknet, Solend on Sui, and more...

Recap: Week of Dec 18th

Launches 🚀

Built by Pomtent Network, Lumio is the first Move L2 that is EVM-compatible, built using the OP Stack, and settles on Ethereum while leveraging Move VM, Aptos’ virtual machine. Lumio is now on testnet and will open up in waves to a whitelist of users over time.

ZKFair launches its mainnet. ZKFair is a community-owned ZK L2 build using Polygon CDK, Celestia DA, and Lumoz RaaS. ZKFair adopts a 100% fair launch approach, all ZKF tokens will be airdropped to the community.

Aori V1 is live on Arbitrum. Aori is a high-frequency orderbook that allows “flash market making”, connecting CeFi/DeFi arbitrageurs to MEV searchers, solvers, and DeFi-native market makers.

Gearbox V3 is live with PURE margin trading, new assets, and better organic rates. APYs depend on TVL migrated, and there is no new inflation in GEAR.

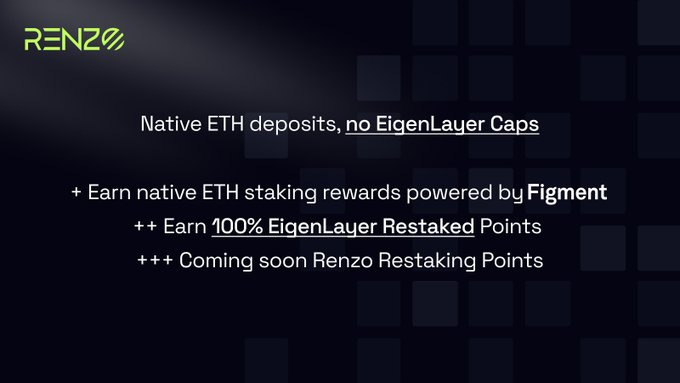

ETH restaking protocol Renzo is live no EigenLayer. Renzo is the interface to the EigenLayer ecosystem securing Actively Validated Services (AVSs) and offering a higher yield than ETH staking.

Web3 portfolio viewer vfat launches Yield, allowing users to compare yield products across DeFi, and enter and exit positions in one transaction.

Updates 🆕

Gearbox has enabled PURE Margin Trading on V3. PURE enables users to trade natively on Uniswap, Curve, and supported DEXes, and offers liquidity for leverage without having any LPs or counter-parties trade against you.

Polytrade launches Phase 1 (private phase) of its RWA marketplace. The marketplace aggregates RWA protocols and RWAs in one platform, RWA partners including Maple, Clearpool, Ondo, etc.

Hyperliquid partners with Privy to enable email login. Users may trade on Hyperliquid with just an email without the need to up a wallet, manage seed phrases, and buy ETH for gas.

Solana-based wallet Phantom now supports trading and transfering for Bitcoin, Ordinals, and BRC-20 tokens.

Render Network announced that it has transferred its tokens onto Solana, changing the token’s ticker from RNDR to RENDER. The Foundation also announced that it has implemented a Burn and Mint Equilibrium (BME) model.

Immutable launched its web3 gaming “Passport”. Passport allows players to use identities and assets with a universal profile across multiple platforms.

B Protocol implemented a smart contract as a MetaMorpho vault’s Allocator, that blocks funds allocation to markets whose risk level became too high. The risk calculation uses SmartLTV’s formula that simplifies LTV ratio calculations, mitigating the human factor in the process.

Frax FXS halving is live, the emissions have halved across all gauges.

Options protocol Bumper launches on Arbitrum, with new markets, price-protected LSD trading, revamped interface, and trading incentives.

RWA protocol Ondo launches USDY, OUSG on Solana. USDY is a tokenized note backed by short-term US Treasuries and bank demand deposits, and OUSG is a wrapper of Blackrock’s Short Treasury Bond ETF.

Ipor launched Stake Rate Swap (SRS), enabling users to hedge, speculate, or arbitrage Lido stETH’s rate with up to 500x leverage.

Restaking protocol EigenLayer raised the staking cap to 500K ETH with 6 LSTs joining the ecosystem: Stakewise osETH, Swell swETH, Origin OETH, Stader EthX, Binance wbETH, and Ankr ankrETH.

Solana-based NFT infrastructure protocol Metaplex introduces Inscriptions and Engravings, a new standard for on-chain NFTs on Solana.

Frax Finance partners with Axelar to support the issuance of Frax-assets on Osmosis, Mantle, Linea, Kujira, Manta, and Scroll.

Hubble Exchange launches trading with three markets live: ETH, AVAX, and SOL. Hubble is a perp orderbook DEX on its own L1.

Circle launches Euro-backed stablecoin EURC on Solana. Solana-based dApps including Jupiter Exchange, Meteora, Orca, and Phoenix have added support for EURC.

Infinex introduced Infinex Account, allowing users to create their account through social sign-in, and interact with Infinex.

Hacks 👾

NFT fractionalization protocol Flooring Protocol was hacked. Nearly $2M worth of NFTs, mostly Bored Apes and Pudgy Penguins, has been stolen. It looks like the vulnerability has been patched by the Flooring team, but users are still recommended to revoke if ever used Flooring.

Arbitrum network went down for ~1 hour last Saturday as “The Arbitrum One Sequencer stalled during a significant surge in network traffic.“ The team has resolved the issue, gas prices have stabilized, and operations are back to normal.

UBI protocol GoodDollar was exploited and lost ~625K. The protocol has paused the distribution of G$ UBI while investigating.

Upcoming ⏳

Ethereum core devs agreed on a tentative date for the first testnet phase of the Dencun upgrade. Devs marked January 17, 2024, for Dencun’s deployment on the Goerli testnet. The Sepolia and Holesky testnet launches are scheduled for January 31 and February 7, 2024.

PancakeSwap proposes to the community to reduce the CAKE token’s total supply to a maximum cap of 450M CAKE. With a current circulating supply of 388M CAKE, the team believes this new and lower cap will be sufficient to gain market share across all chains and sustain the veCAKE model.

Reya will launch Reya Exchange and Reya Network. Reya Exchange will offer CEX trading experience, with on-chain execution & settlement. Reya Network will be a trading-optimized EVM network powered by POlygon CDK.

ZKX will launch on Starknet mainnet in 2024 as a perp DEX that offers CEX-like trading experience. The launch will introduce Clans and Rewards and Airdrop 2.0.

Frax founder mentioned in the Frax Telegram group that Fraxchain will have an airdrop/points system tied to FXS plus something new that has not been announced until the new year.

Lisk announces the transition from an L1 to an Ethereum L2, in collaboration with Optimism and Gelato. LSK token migration will be part of the transition, and the testnet deployment is scheduled in Q1 2024.

Mantle will launch the Double-Dose Drive campaign on Dec 22. Users can stake now and start earning double the market yield staking ETH on MantleLSP later.

WOOFi will launch 1M ARB incentives on WOOFi Swap, Stake, Earn, and Pro in the next three months.

MetisDAO introduced its 4.6M METIS (~$120M) Ecosystem Development Fund (EDF). EDF distribution will be Q1 2024, going to sequencer mining, retroactive funding, deployment of new projects, and other endeavors.

MultiBit will launch an NFT bridge between Bitcoin and Ethereum in the next few days, enabling Bitcoin NFTs to be accessed via Ethereum platforms.

Synthetix is voting to deploy Perps V3, introducing native cross-margining, multi-collateral margin support, revamped liquidations, and improved deterministic settlement.

Kamino will onboard Meteora’s new dynamic liquidity DEX (DLMM) in Q1 2024. DLMM will enable more liquidity strategies, all of which can be fully automated and tokenized via Kamino's vault infrastructure.

Bitcoin-based stablecoin protocol BitStable will support native BTC and BTCB as collateral to mint its DAII stablecoin.

Airdrops 🪂

Solana-based lending protocol Solend plans to launch Suilend on Sui L1 in Q1 of 2024, hinting at an airdrop for Solend users.

Frame announces an initial airdrop that is available to anyone who traded an NFT on ETH in the last two years. Frame is an Arbitrum Nitro-powered L2 launching on Jan 31st.

Farms 🧑🏻🌾

Ichi single deposit pools on Ramses offer good yields (may change as TVLs increase)

Gravita GRAI-USDC LP pool on Bunni offers a good yield with incentives (may change as TVL increases)

Idle boosted yield tranches offer good yields on USDT and USDC on Optimism.

Silo’s sUSDC.e pool on Equilibria earns good yield with boost.

Stella launched new leveraged strategies and a new USDC lending pool with good yield.

Dopex launches rDPX single-sided staking. Users may stake rDPX single-sided to earn rewards. Positions may be locked from a minimum of 1 week to 1 month with a longer lock equating to a larger share of fees.

Delta Prime offers good yields on stable farms on Avalanche.

Today in DeFi Premium includes early looks at promising projects, yield farming tips, and proper research to help you get the most out of DeFi.

For example, last week we published the following features for our Premium Subscribers:

CEX-like Spot Trading with Airdrop Potential

Lending ETH for a High Yield

Leveraged Trade LST Yield

and more…

Keep reading with a 7-day free trial

Subscribe to Today in DeFi to keep reading this post and get 7 days of free access to the full post archives.