Today in DeFi - The 2%, CRV Governance, YFV Rug?

The 2%

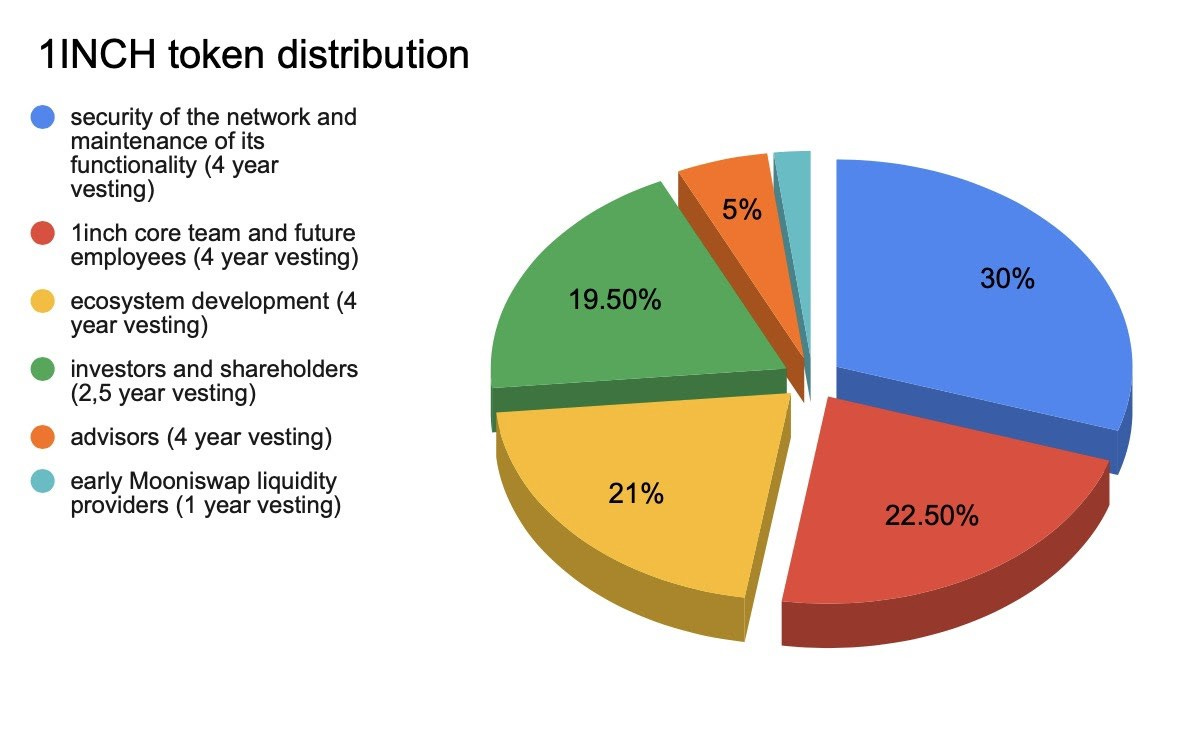

There has been discontent on Twitter about 1Inch.exchange’s token distribution, with some parties feeling that 2% allocated to pre-launch liquidity miners is too sparse.

This discontent may have stemmed from the way the 1Inch team communicated their token distribution. While 2% is distributed to pre-launch liquidity providers, another 21% is the ecosystem development fund, which 1Inch suggests will also be funding LPs.

Whether you think 2+21% is generous or sparse, the discussion does bring up interesting questions about DeFi token distributions and governance.

CRV Governance

CRV Governance drama continues. Curve’s founder wallet increased its time lock yesterday. Due to the weighting formula, this increased their voting power drastically to a commanding majority of the voting pool.

Is voting now centralized?

Curve is now asking more users to vote-lock their CRV. Since only 6.7% of the current supply is votelocked, by time-weighting their votes, users can decentralize the system further as time goes on.

Whether users actually want to do this will depend on their conviction in the protocol, and their liquidity preference for CRV, which may depend on their price forecast for it.

YFV Rug?

@dryrunner pointed out popular new yield farm YFV still has centralized power to lock user funds.

Hours later, YFV team is announcing it will move to a multisig controlled by trusted parties. These parties can be voted on by community members.

Should you mine YFV? Security concerns aside, just like any other Y clone, this seems more focused on earning yield for its founders/users than creating value.

I would recommend focusing on higher value projects. Yield farms aside, there’s still plenty of cool projects being developed in DeFi.