Dolomite - One-Stop DeFi Money Market for Over 1000+ Assets341.9K

his is a preview of the type of content Premium subscribers get every day. If you like this content, consider

.

Dolomite is a next-generation decentralized money market and DEX that combines lending, borrowing, and trading into a highly capital-efficient ecosystem. Its modular architecture allows users to access various DeFi tools while maintaining flexibility for future upgrades.

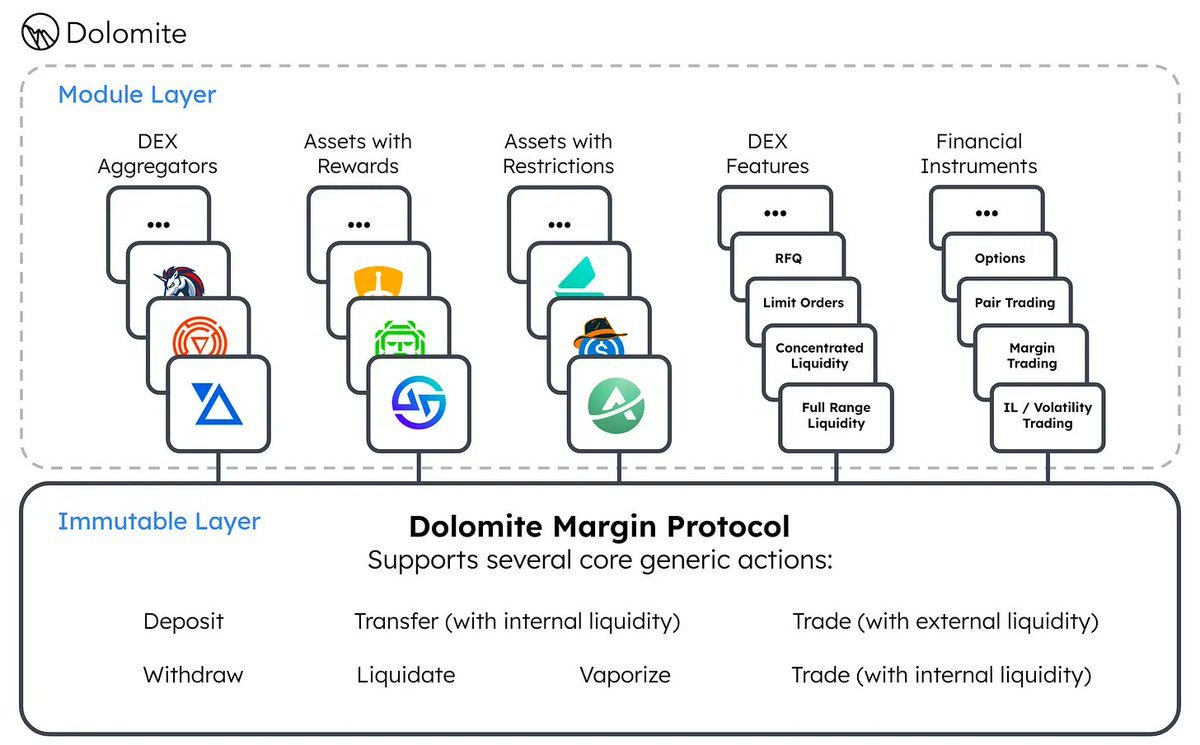

Dolomite has a modular architecture that's composed of two layers - the core (immutable) layer & the module (mutable) layer. The immutable layer safeguards the users’ assets and protects the protocol from malicious attacks, while retaining a high level of modularity to adapt to new environments, trends, and paradigms as DeFi continues to evolve.

The modularity allows Dolomite to be integrated with different protocols and create unique ways for users to manage their assets. The setup opens the doors for a lot of interesting features in the future and new ways to tap into Dolomite. Some examples include:

Pair trading

Impermanent Loss (volatility) trading

Trading within Dolomite using various DEX models (while still earning lending yield at the same time!)

Trading with external sources of liquidity through an aggregator or native DEX adapter

Borrowing against diverse assets while continuing to earn boosted rewards, like GMX’s GLP and Camelot's nitro pools

Listing assets that have restrictions on usage to handle economic and technical risk like Derive's option vaults

Dolomite’s modularity also supports thousands of assets, including non-standard tokens that traditional lending protocols struggle to integrate. This means users can deposit, stake, and borrow against assets like GLP, esGMX, and other specialized DeFi tokens while still accessing their native benefits, such as staking rewards or governance rights.

Dolomite Balances

Dolomite Balance represents a user's virtual liquidity within the protocol. All deposits are aggregated into this balance and can be used across Dolomite’s services, including trading, borrowing, pooling, and leveraging. Since transactions within Dolomite do not require on-chain transfers, capital efficiency is maximized, and users can execute complex DeFi strategies without moving assets between wallets.

Dolomite’s virtual liquidity system enables users to simultaneously earn lending yield and swap fees. Unlike traditional money markets, Dolomite allows liquidity to be reused across multiple functions, ensuring that assets are always working for the user. For example, users can trade with internal liquidity while keeping their funds within the system, reducing borrow interest rates and improving liquidity availability.

Dolomite Leveraged Lending Guide

The Balance function allows users to utilize the liquidity supplied to Dolomite simultaneously across lending, swapping, and borrowing. Through bundling the transactions, users can easily create leveraged lending positions on Dolomite to earn multiplied yields.

Go to the Balance page on Dolomite

2. Choose the Asset to Deposit

3. Enter Deposit Amount and Initiate Deposit In this example we will deposit sUSDe

4. Go to the Strategies page

5. Go to the s to build leveraged positions In this example we will select 3x Looped sUSDe with USDC as the funding currency

6. Read the strategy breakdown and risk factors Looped sUSDe strategy borrows flash loan, swap borrowed USDC into sUSDe, put all sUSDe as collateral, and borrow USDC against sUSDe collateral to repay the flash loan

7. Select the amount of pre-deposited sUSDe to put into the strategy

8. Initiate the transaction and confirm the transaction

9. Make sure to check if there’s any reward to be claimed here if the strategy is not auto-compounding.

Risks Involved

⚠️ Dolomite smart contract risk

Security

✅ Dolomite is

by Open Zeppelin, Cyfrin, SECBIT, Brahma Systems, Zokyo, and Guardian

The audit does not guarantee any hacks. Please do not invest with more than you can afford to lose.

This is a preview of the type of content Premium subscribers get every day. If you like this content, consider