Easy Exposure to DeFi Growth

What if you could get easy access to curated DeFi tokens, through a single ticker?

Thanks to Reserve Protocol's new DTFs, and Today in DeFi Research, you can.

DTFs = ETFs, but better

The Reserve Index Protocol is a decentralized infrastructure that enables the creation and management of index-based Decentralized Token Folios (DTFs), which function similarly to an ETF in traditional finance but operate entirely through smart contracts in DeFi, allowing users to bundle multiple tokens into a single, redeemable unit backed 1:1 by the underlying assets on-chain. It allows for permissionless index composition without relying on external oracles, collateral adapters, or centralized governance.

Reserve Index Protocol is a seamless and flexible framework for creating and managing diversified index baskets. The core elements are:

Creation & Redemption: Users can directly mint or redeem index DTFs via smart contracts, ensuring each DTF is fully backed by a basket of underlying assets. DTFs are redeemable 1:1 for the tokens in the basket.

Incentive Structure: DTF creators have the flexibility to customize fee structures to align with their goals and incentivize various stakeholders.

RSR Burn Mechanism: To enhance the value and sustainability of the protocol, a portion of the fees collected from index RTokens is used to burn RSR (Reserve Rights token).

Decentralized Access: The protocol ensures transparent and inclusive access, allowing anyone to participate in creating, managing, or governing DTFs.

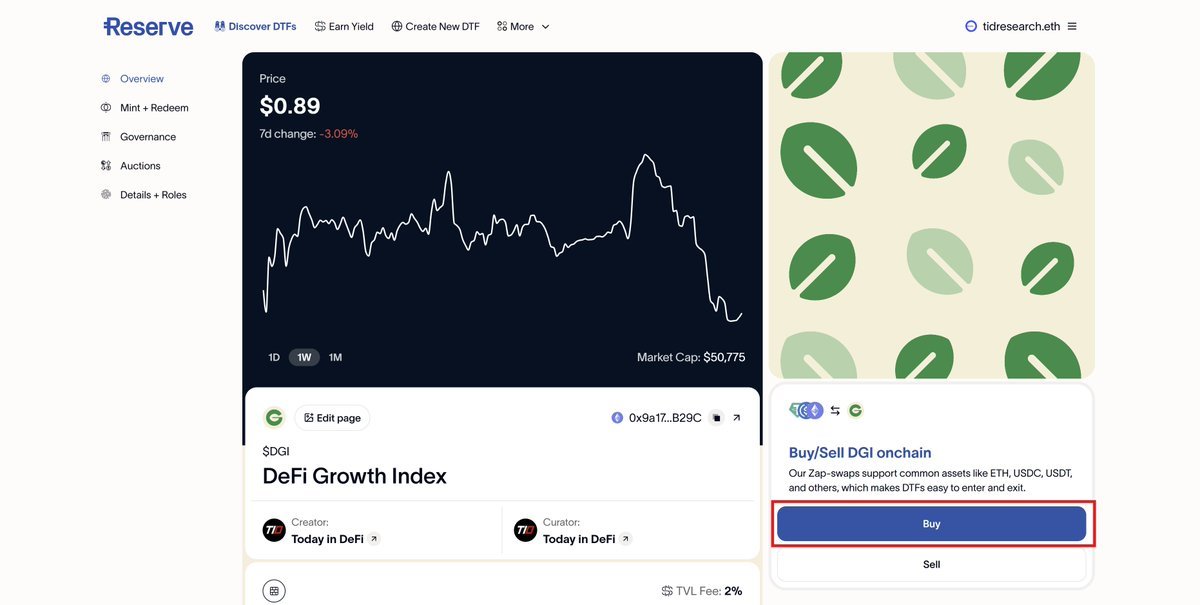

DeFi Growth Index (DGI) Overview

The DeFi Growth Index (DGI) is a curated index by Today in DeFi that tracks the performance of early-stage DeFi projects with growth potential. It highlights projects with innovative mechanisms, market demand, and measurable expansion in user base, transaction volume, and Total Value Locked (TVL). For more details, visit the

Index Constituents

Morpho Token ($MORPHO) – Modular lending protocol that optimizes rates by combining peer-to-peer lending with Aave and Compound’s liquidity pools.

Fluid ($FLUID) – Multi-functional protocol integrating lending, DEX aggregation, and looping strategies with smart debt & collateral optimization for efficient leverage management.

CoW Protocol Token ($COW) – A DEX utilizing intent-based swaps, where orders are batched and matched peer-to-peer before routing to external liquidity sources, minimizing MEV.

Balancer ($BAL) – Automated liquidity management & rehypothecation protocol that allows users to create customizable liquidity pools with dynamic weights and automated rebalancing.

Euler ($EUL) – Modular lending platform offering advanced risk-adjusted collateral models, now operating as Euler v2 with enhanced security and optimizations.

Maple ($SYRUP) – Real-world asset (RWA) lending platform providing institutional loans backed by tokenized real-world assets, bridging traditional finance and DeFi.

Derive ($DRV) – DEX and option-writing vault protocol enabling automated covered call and put selling strategies for decentralized derivatives.

Bunni ($LIT) – Liquidity incentive token (LIT) protocol offering automatic liquidity management & rehypothecation, optimizing capital efficiency for liquidity providers.

f(x) Protocol ($FXN) – Stablecoin protocol that issues overcollateralized stablecoins with a leveraged token buffer, enhancing stability.

IPOR Token ($IPOR) – DeFi interest rate derivatives protocol enabling users to hedge or speculate on interest rate movements through optimized yield vaults.

Basket Governance

The DeFi Growth Index (DGI) is governed by the

token, requiring holders to vote-lock their tokens to become governors of the index. Governors have the ability to propose changes to the index basket and vote on proposals submitted by others. In return for participating in governance, they earn a share of the Total Value Locked (TVL) fee collected by the DeFi Treasury Fund (DTF).

Security of Reserve Protocol

✅ Reserve Protocol is

by Trails of Bits, Solidified, Ackee, Halborn, Trust Security, and Code4rena.

✅ Reserve Index Protocol has an

of $60,000 partnered with Cantina

The audit does not guarantee any hacks. Please do not invest with more than you can afford to lose.

User Guide

Method 1: Buy via Zap-Swap

Go to the Reserve DeFi Growth Index page and connect your wallet.

Scroll down and read the “About this DTF” section to understand the index components, basket governance, and disclosures before depositing.

Click “Buy” on the right side, then select and enter the amount of tokens you want to deposit.Note: Reserve Zap-swaps support common assets like ETH, USDC, USDT, and others, making it easy to enter and exit DTFs.

4. Review the swap result. Once confirmed, click “Buy DGI” and approve the transaction.

5. Regularly check back to track the price of $DGI , index performance, and token composition with updated percentage allocations

Method 2: Mint & Redeem for Large Amounts

If you want to buy or sell a large amount, liquidity may be insufficient. In this case, go to the Mint & Redeem section.

Enter the amount of DGI you want to mint, check the required amount of euch tokens, and approve the transaction in your wallet. To redeem, follow the same process in reverse.

Official Links

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, legal, or tax advice. Today in DeFi does not issue, manage, or control any tokens, protocols, or investment products mentioned. DeFi investments carry significant risk, including potential loss of funds due to smart contract vulnerabilities, market volatility, or regulatory actions. Users should conduct their own due diligence and consult professional advisors before participating.

Today in DeFi is not liable for any losses incurred from interacting with Reserve Protocol, the DeFi Growth Index (DGI), or related platforms. Security audits do not guarantee the absence of risks. Engage with these protocols at your own riskand only invest what you can afford to lose.