JLP Navigator II: 40% APR with Downside Protection

Building upon the foundation of the original JLP Navigator Vault, Vectis introduces the JLP Navigator II Vault, offering an estimated Annual Percentage Rate (APR) of 47.25%.

This advanced vault combines dynamic hedging, strategic yield optimization, and an industry-first insurance fund to provide stable, risk-adjusted returns for USDC depositors.

How JLP Navigator II Improves on its Predecessor

JLP Navigator Vault introduced delta-neutral yield farming, allowing users to capture JLP’s yield while mitigating directional exposure. JLP Navigator II expands on this concept with:

✔ Insurance Protection – Vectis' insurance fund absorbs losses beyond a 5% drawdown, adding a layer of security not present in the first vault. ✔ More Dynamic Hedging – Real-time tracking of Jupiter Perpetuals activity optimizes hedge efficiency. ✔ Enhanced Yield Optimization – Adjustments based on stablecoin APY spikes and JLP’s premium/discount cycles allow for more efficient returns. ✔ Improved Rebalancing Mechanism – More frequent delta and time-based rebalancing keeps the vault market-neutral with lower trading costs.

These upgrades aim to deliver better risk-adjusted returns while ensuring capital protection remains a priority.

Key Features of JLP Navigator II

1. Insurance Fund Protection

A first in DeFi vault strategies, Vectis' insurance fund provides an added safeguard for depositors:

If drawdowns exceed 5%, the fund automatically covers the excess losses, protecting user capital.

Actively managed reserves ensure liquidity is available to cover potential downside risks.

This creates greater investor confidence, mitigating concerns over market volatility.

2. Yield Optimization & Strategic Reserve Allocation

JLP Navigator II refines its approach to yield farming by:

Capturing JLP’s natural yield while leveraging inefficiencies in premium/discount cycles.

Monitoring stablecoin APYs to take advantage of sudden yield spikes while ensuring liquidity remains available.

Earn

Points: Depositing in the JLP Navigator II Vault also earns

points, which will be airdropped as

tokens by the Drift team in the coming months. This provides an additional yield opportunity for users looking to maximize their returns.

3. Dynamic & Adaptive Hedging

A market-neutral approach ensures that depositors' returns remain unaffected by fluctuations in SOL, ETH, and BTC prices.

Hedged short positions on Drift neutralize exposure to market volatility.

Continuous monitoring of trader behavior and volatility levels guides hedge adjustments.

Rebalancing adjusts positions dynamically to maximize efficiency.

4. Robust Rebalancing Mechanism

Two key rebalancing strategies are in place to maintain portfolio stability:

Delta Rebalancing: Adjusts hedging positions when exposure surpasses 2% of the vault’s net value.

Time-Based Rebalancing: Every 8 hours, the vault reassesses its exposure and rebalances positions to maintain delta neutrality while reducing unnecessary trading fees.

Withdrawal Terms & Fees

JLP Navigator II ensures liquidity while structuring withdrawal terms for efficiency:

Redemption Period: Withdrawals can be requested at any time but are subject to a 1-day redemption window. Profits accrued during this period are not credited.

Airdrop Handling: Unexpected airdrops (e.g.,

,

) incur a 20% fee, while 80% is distributed proportionally to depositors.

Performance-Based Fee: No management fees—a 25% performance fee applies only to profits, aligning incentives with depositor success.

How to Use the JLP Navigator II Vault

Participating in the JLP Navigator II Vault is straightforward. Follow these steps:

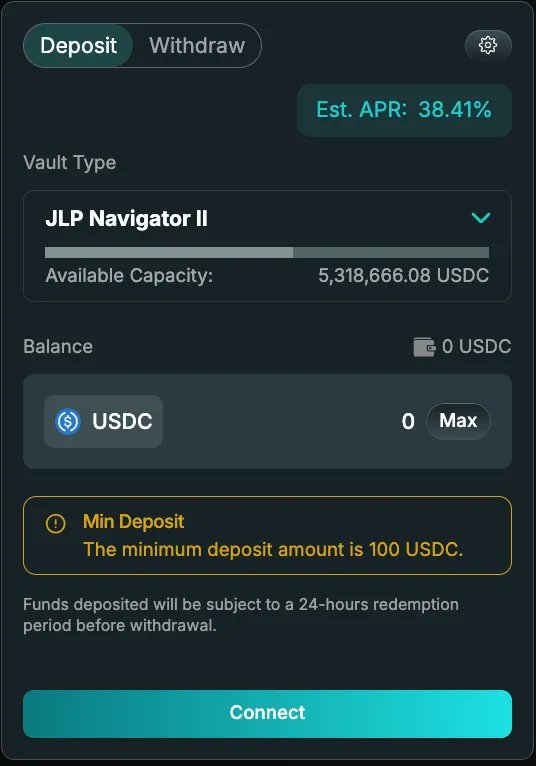

Access the Platform

Navigate to the Vectis Finance website and select the JLP Navigator II Vault.

2. Connect Your Wallet

Click on the "Connect Wallet" button and choose your preferred wallet provider. Ensure your wallet contains USDC for deposit.

3. Deposit Funds

Enter the amount of USDC you wish to deposit into the vault.

Confirm the transaction in your wallet.

4. Monitor Performance

After depositing, you can track your investment's performance directly on the platform.

The vault employs dynamic strategies to optimize yields while managing risks.

5. Withdraw Funds

To withdraw, initiate a request on the platform.

Withdrawals are subject to a 1-day redemption period.

During this time, profits accrued will not be credited and will be forfeited.

Withdrawal Terms & Fees

Redemption Period: Withdrawals can be requested at any time but are subject to a 1-day redemption period.

Airdrop Fees: A 20% fee applies to airdrops or unexpected returns, with the remaining 80% claimable based on a time-weighted calculation.

Performance Fee: A 25% performance fee is applied only to profits, ensuring alignment between user success and vault incentives.

Potential Risks

Despite its risk management features, JLP Navigator II carries certain risks:

Smart Contract Risk: The vault interacts with Jupiter and Drift, both of which have undergone security reviews but remain exposed to smart contract vulnerabilities.

Hedging Risks: Market volatility in SOL, ETH, or BTC could cause temporary inefficiencies in hedge execution, though continuous monitoring minimizes exposure.

Why Upgrade to JLP Navigator II?

JLP Navigator II enhances its predecessor by adding protection, increasing efficiency, and fine-tuning strategies for more stable yield generation.

✔ First insured DeFi vault – Vectis’ insurance-backed model adds a new layer of security. ✔ More refined yield strategy – Improved hedging and premium trading capture more value. ✔ Designed for long-term sustainability – Adaptive risk management ensures stable, market-neutral returns.

For a deeper analysis of the strategy and performance, read the whitepaper: 🔗 JLP Navigator II Vault Whitepaper

JLP Navigator II builds on the success of its predecessor while introducing more robust risk controls and optimization mechanisms. With Vectis’ insurance protection, enhanced hedging strategies, and a structured yield approach, it presents a compelling alternative for investors looking for stable, high-yield opportunities with reduced market exposure.

Click here to start Earning with JLP NAVIGATOR VAULT II

Today in DeFi is supported by Vectis Finance