SynFutures Introduces Synthia AI Agent for Twitter-Based Trading

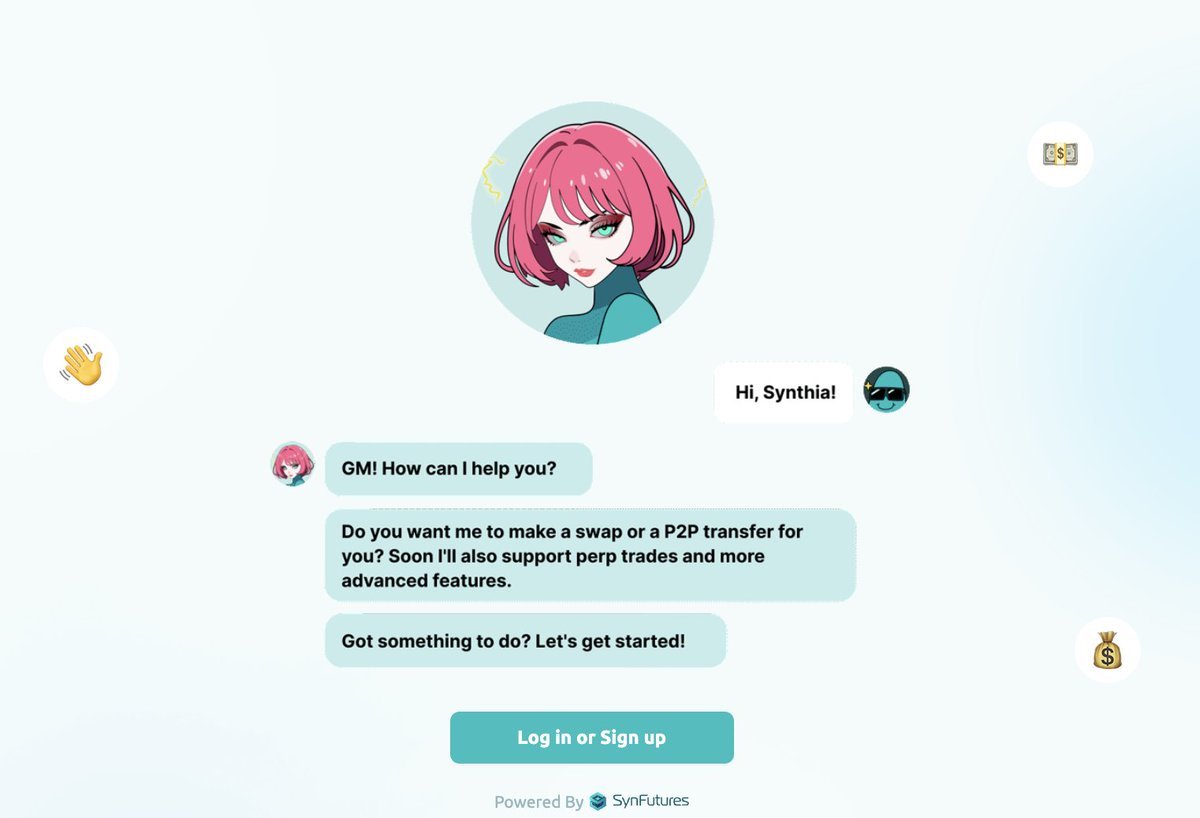

SynFutures launches its AI framework with its first AI agent Synthia, an AI-powered trading tool designed to facilitate spot trading directly on Twitter. It aims to provide a more accessible and efficient way for users to engage with decentralized finance (DeFi) through natural language commands.

Overview of the Synthia AI Agent

Synthia enables users to execute trades without needing a traditional trading terminal. Instead, transactions can be performed by tagging the AI agent in a tweet and using simple text-based commands. In the backend, Synthia will handle the swap on SynFutures Spot Aggregator.

Key Features at Launch:

Spot Swaps – Trade select token pairs on SynFutures Spot Aggregator without leverage.

Trading via Twitter – Execute trades by tagging the AI Agent, removing multiple steps with different user interfaces.

Natural Language Commands – Users can submit trades with simple messages like "Swap 100 USDC for VIRTUAL"

P2P transfer – Users can make a quick transfer to any ENS address "Send 100 USDC to example.eth"

At launch, the agent will support spot trading only, with additional features such as providing market insights, copy trading, perpetual trading, stop-loss functionality, and limit orders expected in future updates.

Comparison with Other AI Trading Agents

Several AI-powered trading assistants have emerged in the DeFi space, each offering different functionalities. Synthia distinguishes itself by enabling spot trading directly on Twitter with natural language commands, reducing complexity for users who prefer a more intuitive approach.

Compared to other AI agents, Synthia provides:

Trading via Twitter – Users can execute trades without leaving the platform, whereas some agents operate on other interfaces such as Telegram or proprietary dashboards.

Natural Language Support – Unlike certain AI agents that require specific commands, Synthia allows users to trade using conversational language.

Spot Trading at Launch – While some AI agents specialize in token launches or liquidity provisioning, Synthia focuses on direct spot trading execution, with plans to expand into leverage trading, stop-losses, and cross-chain functionality in future updates.

By integrating trading capabilities within a widely used social platform, Synthia aims to provide a more accessible and user-friendly trading experience. Future updates will further expand its functionalities, positioning it as a versatile AI-driven trading assistant.

Potential Benefits for Traders

The integration of AI into trading through social media platforms introduces several efficiencies:

Simplified Execution – Trades can be performed according to commands on Twitter, allowing users to get into the hottest tokens instantly.

Accessibility – Natural language commands reduce the complexity of interacting with DeFi protocols, reducing barriers for normies.

Scalability – Future updates will include additional functionalities such as perpetuals, stop-loss orders, and cross-chain trading.

Upcoming Features and Roadmap

Following its initial launch, SynFutures plans to expand the AI Agent’s capabilities with new features:

✔ Market Insight Updates ✔ Limit Orders & Stop-Loss Functionality ✔ Leverage Trading via Perpetual Swaps ✔ Cross-Chain Trading Integration

Conclusion

The launch of Synthia AI Agent introduces a new approach to DeFi trading by integrating AI-driven trade execution into Twitter. While initially limited to spot trading, the planned expansion to include leverage trading and advanced order types suggests a broader vision for AI-assisted trading.