defi 101: intro to pendle yield trading

Core Concepts

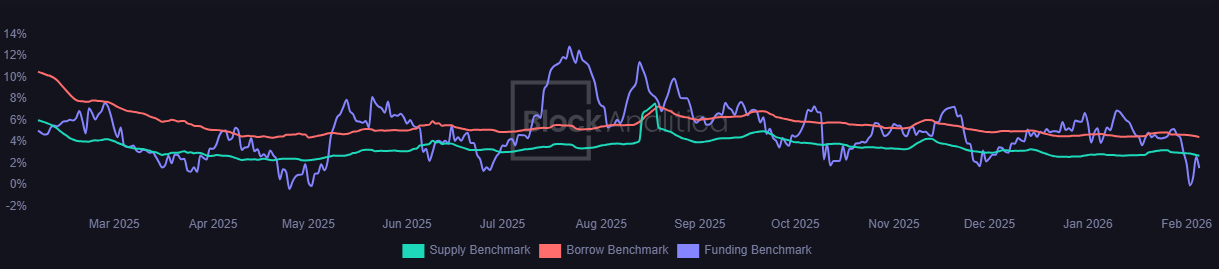

Yield Fluctuations: DeFi yields rise in bull markets and fall in bear markets, with additional fluctuations caused by micro and macro factors.

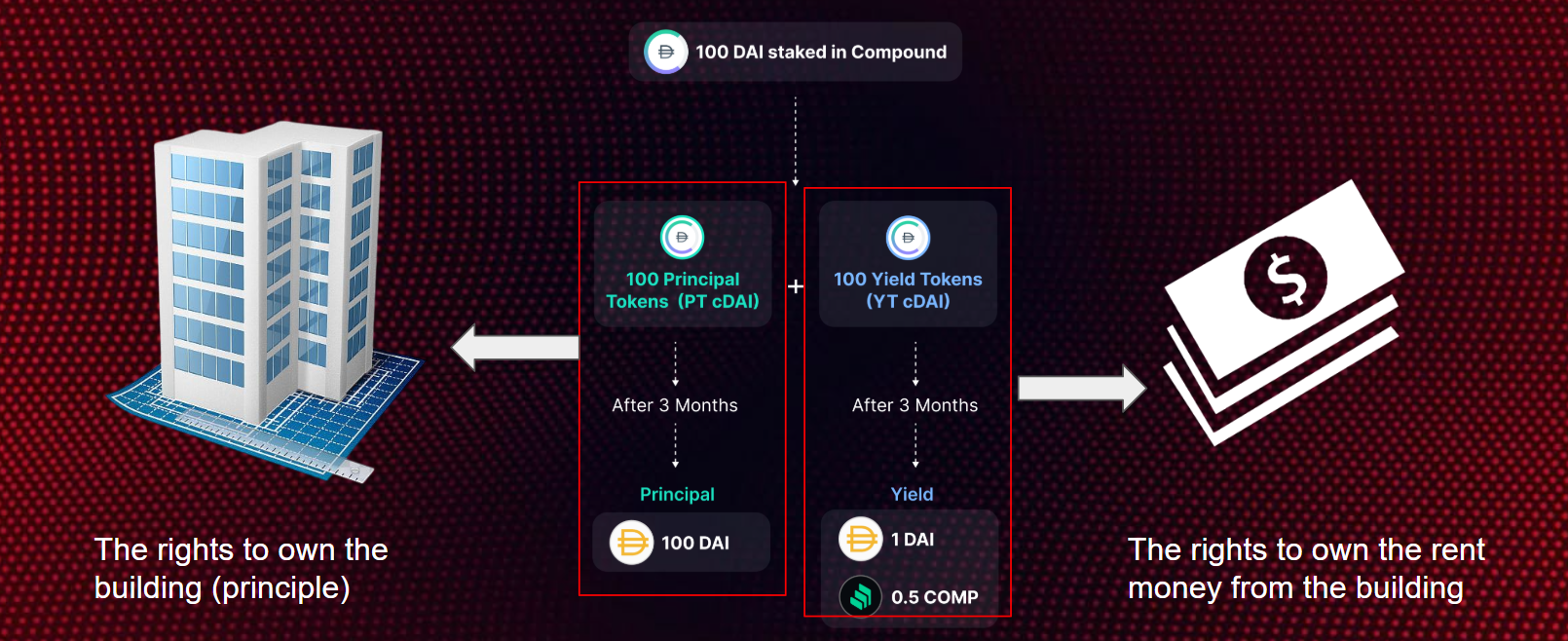

Pendle’s Solution: Pendle enables users to split yield-bearing assets into two separate tradable tokens:

Principal Token (PT): Represents the principal amount (like owning a building). It can be redeemed at maturity for the full principal, offering predictable fixed income.

Yield Token (YT): Represents the right to receive future yield (like the “rent” from the building). YTs allow users to speculate on future yield changes.

Detailed Explanation of Pendle’s Mechanism

When you stake a yield-bearing token (e.g., 100 DAI in Compound), you receive an APY yield (e.g., 5%).

Pendle splits this staked asset into:

PT: Sold at a discount (e.g., 0.9 DAI for 1 PT DAI) because it does not include yield.

YT: Represents the yield part, priced much lower, reflecting only the future interest.

PT holders can redeem 1 PT for 1 underlying token at maturity, locking in a fixed yield.

YT holders continuously receive the yield during the period and speculate on yield fluctuations, which involves higher risk and the potential for higher returns.

Key Features and User Strategies

PT Tokens (Fixed Yield/Lower Risk):

Ideal for users seeking predictable, fixed returns.

PT is always cheaper than the underlying asset.

PT holders redeem principal at maturity, gaining fixed yield regardless of interim yield fluctuations.

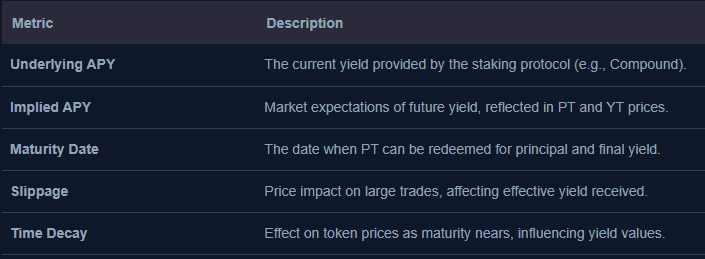

PT price and yield can be influenced by market expectations and time decay as maturity approaches.

Users can trade PT tokens before maturity, potentially realizing capital gains if implied yields decrease.

YT Tokens (Speculative/High Risk):

Suitable for advanced traders speculating on the future direction of yields.

YT price fluctuates based on implied APY expectations relative to the underlying APY.

High potential yields (e.g., 100% APY) can be achieved by correctly timing the market.

Requires understanding of yield sources and risks, including volatility and protocol-specific strategies.

Important Metrics and Trading Considerations

Practical Examples

Stablecoin Yield Trading:

Pendle is gaining popularity through stablecoin markets (e.g., SUSDF, YOUSD).

Example: PT SUSDF offers ~29% fixed APY for a 12-day maturity at a discounted price.

Users can lock fixed yields with PTs or speculate on yields with YTs.

Capital Gains and Impermanent Loss:

Buying PT when yields are high but then yields rise further can cause temporary “impermanent loss.”

However, at maturity, PT holders receive the locked-in yield and principal, eliminating permanent loss.

Conversely, buying PT as yields fall results in capital gains plus locked yield at maturity.

Yield Source Understanding:

Knowing the underlying protocol and yield strategy (e.g., Delta neutral strategies for YOUSD) is critical for valuation and risk assessment.

Key Insights

Pendle enables fixed income and speculative trading on DeFi yields, offering a novel way to manage yield risk.

PT tokens provide predictable income, akin to bonds in traditional finance, suitable for risk-averse investors.

YT tokens offer high-risk, high-reward exposure to future yield fluctuations, recommended for experienced DeFi traders.

Market dynamics such as time decay, slippage, and maturity timelines critically influence token pricing and yield outcomes.

Understanding the underlying APY and implied APY is essential for informed trading and yield speculation.

Pendle is increasingly popular in stablecoin markets, reflecting growing demand for fixed and tradable DeFi yields.