DEFi 101: Intro to aave protocol, defi lending and borrowing.

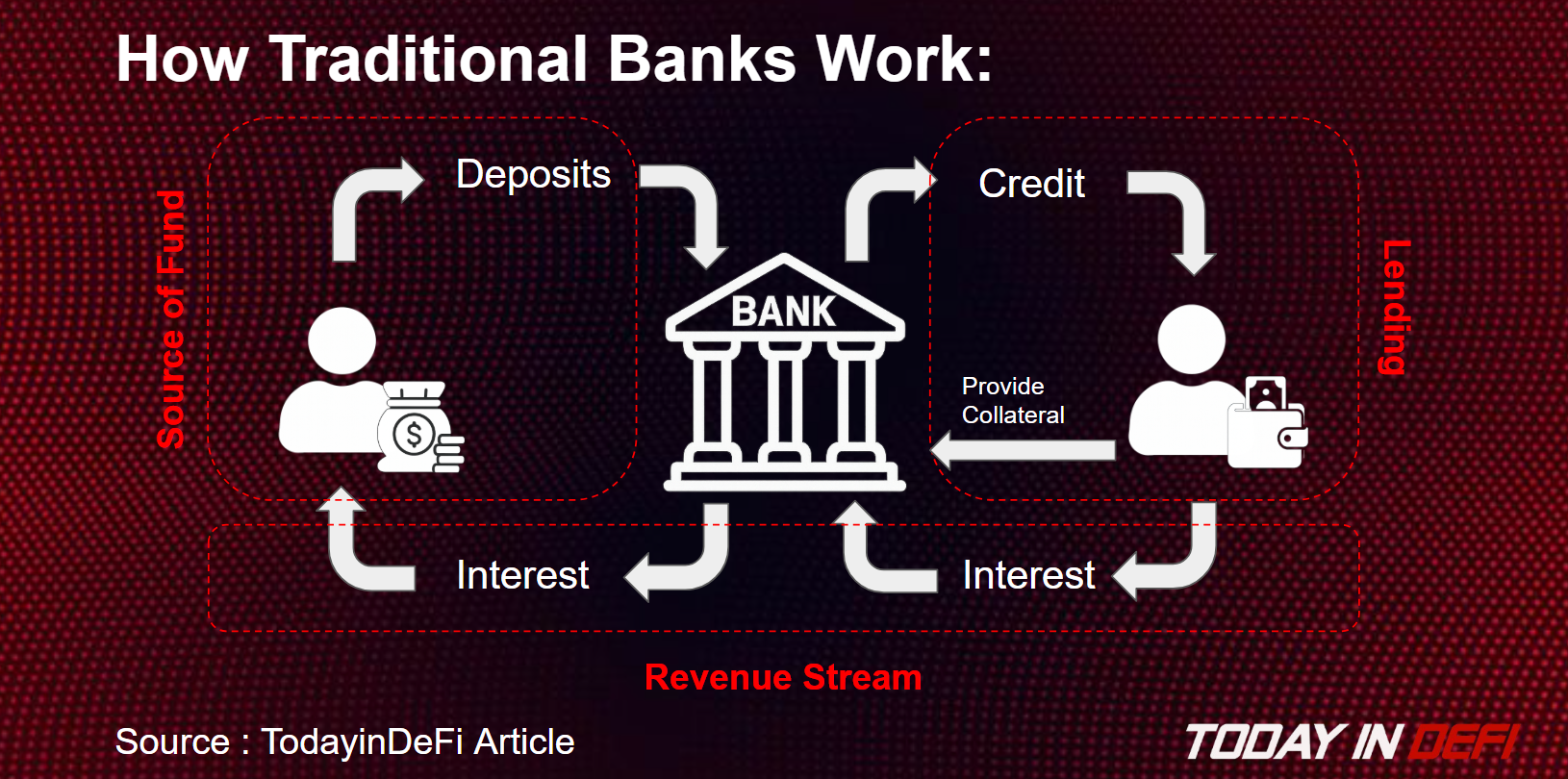

Traditional Banking vs. DeFi Lending

Traditional Banks operate by accepting deposits from customers and lending those funds as credit to borrowers.

Banks earn money through the net interest margin — the difference between the interest charged to borrowers and the interest paid to depositors (e.g., charging 10% interest to borrowers and paying 5% to depositors).

Borrowers provide collateral, but banks often lend more than the collateral’s value, creating risk if borrowers default.

Banks act as intermediaries, controlling funds and credit allocation centrally.

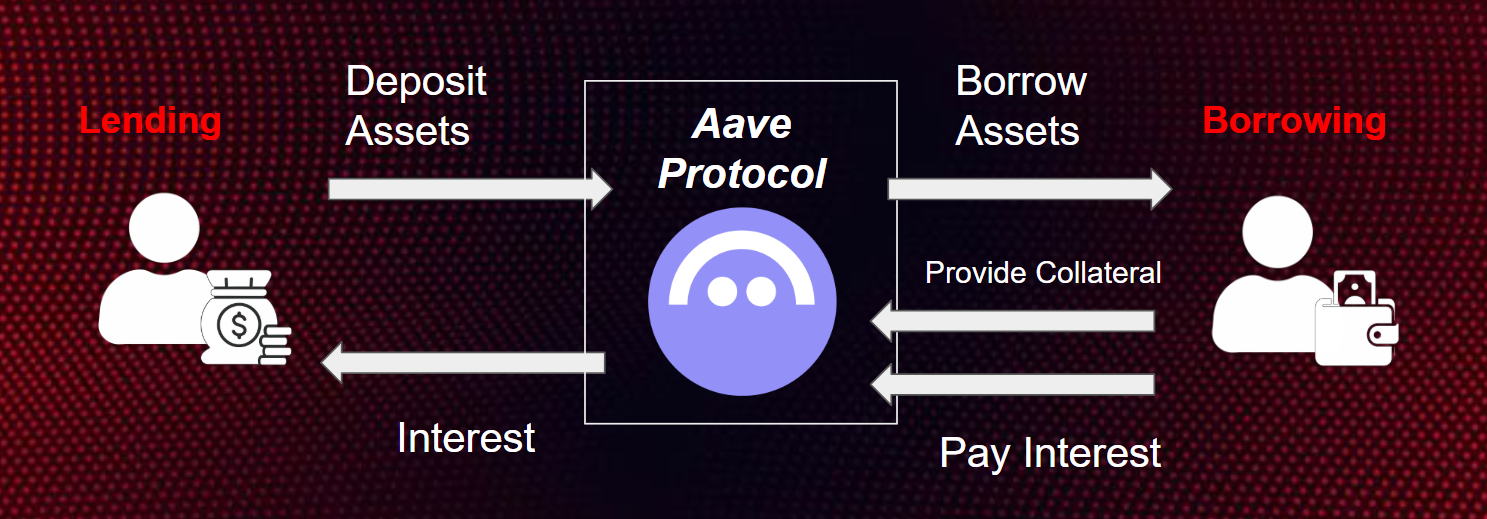

DeFi Lending and Borrowing with Aave Protocol

Aave is a decentralized lending and borrowing protocol operating on blockchain using smart contracts.

It functions similarly to banks but is P2P, self-custodial, and decentralized with no intermediaries controlling user funds.

Users can be lenders (depositors) or borrowers:

Lenders deposit cryptocurrencies such as ETH, BTC, USDC, USDT to earn interest.

Borrowers provide over-collateralized assets to borrow, minimizing default risk.

DeFi allows users to earn higher yields than traditional banks and provides 24/7 access to lending/borrowing with full transparency.

Users receive aTokens when they deposit, which are yield-bearing and composable—usable in other DeFi protocols for additional yield farming.

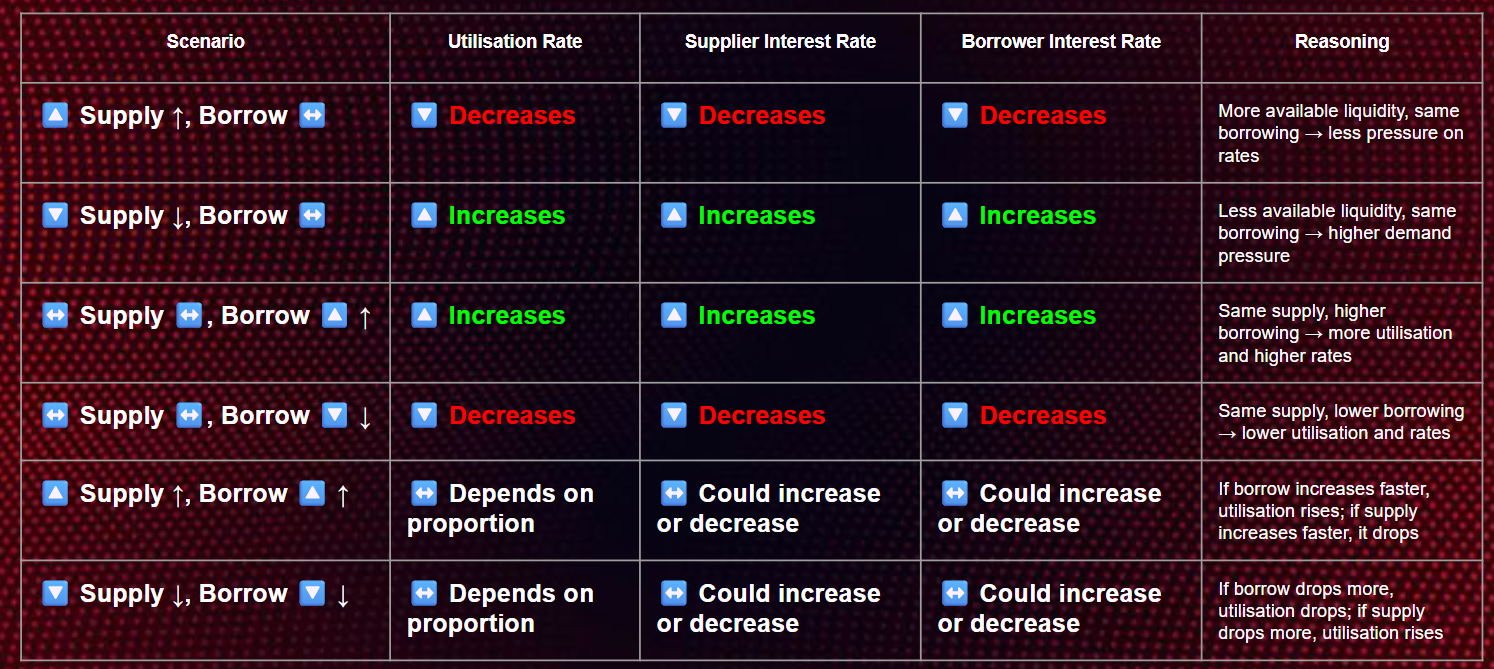

Interest Rate Mechanism and Utilization Ratio

Interest rates for borrowing and lending depend on the utilization ratio, calculated as:

Utilization Ratio= Total Borrowed/Total Supplied

Four core scenarios govern interest rates:

Liquidation and Risk Management

The health factor measures loan safety, calculated as:

[ \text{Health Factor} = \frac{\text{Collateral Value} \times \text{Liquidation Threshold}}{\text{Borrowed Amount}} ]

A health factor below 1 triggers liquidation.

Example: Borrowing $2,500 USDT against 1 ETH collateral worth $3,500 at a 78% liquidation threshold yields a health factor ~1.1, which is risky.

Liquidation involves repaying up to 50% of the borrowed amount by liquidators with a penalty (e.g., 4.5% on seized collateral).

Liquidation processes are automated, permissionless, and executed by bots for rapid response.

Aave’s New Safety Mechanism: Umbrella Safety Module

Umbrella replaces the legacy safety model to prevent bad debt by allowing users to stake yield-bearing A tokens and the native stablecoin GO.

It enables automated burning of staked assets to cover deficits without manual governance intervention.

Benefits:

Faster and more efficient risk management.

Incentivizes users to contribute to protocol safety.

Staked tokens remain usable for yield farming in other protocols, enhancing composability.

The GO Token: Aave’s Native Stablecoin

GO token is a collateral-backed stablecoin pegged to USD, minted by depositing collateral (e.g., ETH).

Borrowing GO currently has an interest rate of about 5% APY.

Depositing GO into the protocol’s savings yields approximately 7.7% APY.

GO has a borrow cap (e.g., $220 million), with current borrows around $188 million.

GO tokens are highly composable, enabling multiple yield farming strategies.

Key Insights and Conclusions

DeFi lending protocols like Aave provide greater transparency, decentralization, and accessibility compared to traditional banking.

Over-collateralization in DeFi reduces risk of default, unlike traditional banks where credit can exceed collateral value.

Interest rates are dynamically adjusted based on utilization ratios, balancing supply and demand efficiently.

The Umbrella Safety Module enhances protocol resilience by automating risk mitigation and eliminating slow governance responses.

The GO stablecoin introduces new opportunities for stable and composable yield farming.

DeFi offers users the ability to be their own bank, with 24/7 access, higher yields, and composability across protocols.

Users should be aware of liquidation risks and health factors to manage borrowing safely.

DeFi’s evolving mechanisms enable creative strategies for yield maximization and risk management.