Earn >20% usd yield on Mooncake.fi

This is a preview of the type of content Premium subscribers get every day. If you like this content, consider getting a paid subscription.

The mUSD vault on Mooncake is a yield-bearing stablecoin strategy that acts as the counterparty to leveraged traders on the platform. Unlike standard lending pools, this vault represents the “Funding Position” of the Mooncake ecosystem. Its yield (currently ~24% APY) is derived entirely from the funding fees paid by users holding “liquidation-free” 10x leveraged tokens (e.g., 10xSOL). It offers a delta-neutral, high-yield opportunity for stablecoin holders who want to capture the “cost of carry” from bullish traders.

1. Protocol Overview: Mooncake & RateX

Mooncake is a consumer-facing sub-protocol of RateX on Solana. While RateX focuses on yield trading (splitting assets into Principal and Yield tokens), Mooncake utilizes this infrastructure to offer Liquidation-Free Leveraged Tokens.

The Product: Mooncake allows “degens” to buy leveraged positions (like 10xSOL) that do not have hard liquidation prices. Instead, they pay a continuous stream of funding fees to maintain the position.

The Role of mUSD: mUSD is the liquidity provided to these leverage traders. It effectively acts as the “bank” lending out the capital.

2. Mechanics: How mUSD Generates Yield

The “Funding Position” Model

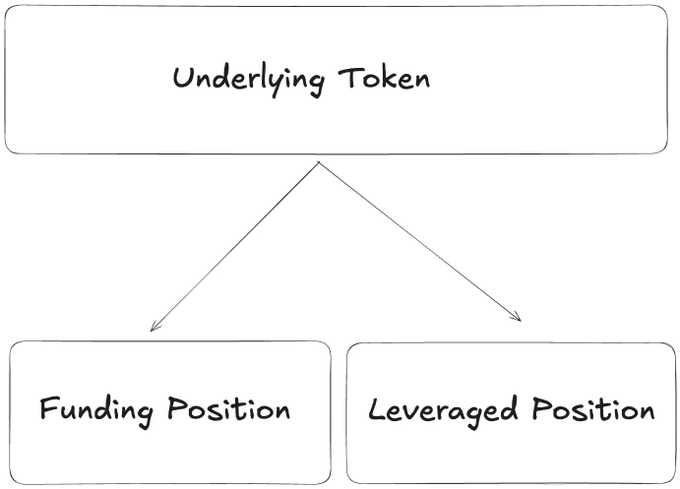

Mooncake splits the market into two sides:

Leveraged Position (The Borrower): Traders buy 10xSOL to get amplified exposure. They pay a funding fee for this privilege.

Funding Position (mUSD - The Lender): You deposit stablecoins to mint mUSD. This token collects the funding fees paid by the leveraged traders.

Metrics Explained

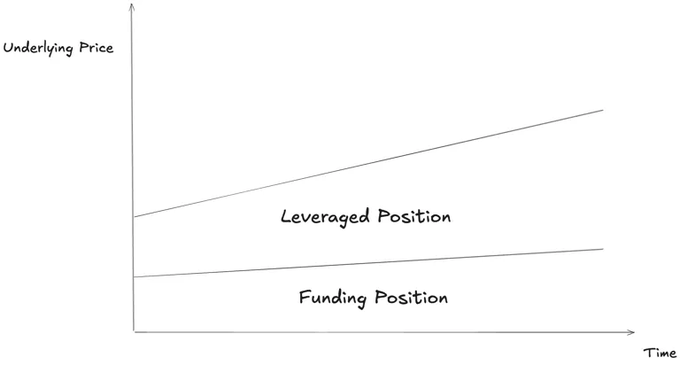

Funding Token Price: Unlike a rigid stablecoin (USDC), mUSD is an accumulation token. The funding fees paid by traders are likely added to the pool, causing the price of mUSD to slowly appreciate over time (rising above $1.00) rather than paying out a separate cash dividend.

Funding APY: This is the annualized rate of return based on the current demand for leverage. In a bull market where many traders are buying 10xSOL, this rate increases.

Coverage Ratio: This is a critical health metric. It likely represents the ratio of Total Liquidity (TVL) vs. Utilized Liquidity (or Open Interest). A high ratio (>100%) means the vault is over-collateralized and there is plenty of liquidity for LPs to exit.

3. Step-by-Step User Guide

Prerequisites

Network: Solana.

Wallet: Phantom, Solflare, or Backpack.

Assets: USDC (Solana native).

Execution

Navigate to Mooncake: Access the official Mooncake.

Select the Market: Look for the “Earn” or “Funding” tab.

3. Navigate to the 10xSOL_Market.

4. Mint mUSD: Deposit USDC. The protocol will mint mUSD (the funding token) to your wallet. Note: You are effectively “buying” the funding token at its current price.

5. Hold to Earn: There is no “staking” required. As long as you hold mUSD, it appreciates in value as funding fees are accrued.

6. Exit (Redeem): To realize profits, you swap or redeem mUSD back for USDC. The amount of USDC you receive should be higher than your deposit, reflecting the accumulated yield.

4. Risk Scrutiny & Warnings

While this is a “stable” strategy relative to holding SOL, specific risks exist:

Utilization Risk (Liquidity Crunch): If the “Coverage Ratio” drops significantly (meaning almost all USDC has been lent out to leveraged traders), you might face withdrawal delays. You would have to wait for traders to close positions or for new LPs to enter before you can redeem your mUSD for USDC.

Smart Contract Risk: Mooncake is a newer protocol (V2 of RateX). Complex mechanisms involving leverage tokenization and yield splitting introduce potential attack vectors.

Demand-Driven Yield: The 24% APY is variable. If the market turns bearish or sideways and traders close their 10x long positions, the funding fees will drop, and your APY could decrease significantly.

Soft Peg Risk: mUSD is not USDC. It is a derivative token representing a share of the funding pool. Its value is tied to the solvency of the Mooncake protocol.